Excitement About Pvm Accounting

Excitement About Pvm Accounting

Blog Article

Indicators on Pvm Accounting You Need To Know

Table of ContentsNot known Details About Pvm Accounting The Definitive Guide to Pvm AccountingThe 25-Second Trick For Pvm AccountingAll About Pvm AccountingRumored Buzz on Pvm AccountingThe Buzz on Pvm Accounting

Supervise and manage the creation and approval of all project-related invoicings to clients to cultivate excellent communication and avoid concerns. Clean-up bookkeeping. Guarantee that appropriate reports and documentation are sent to and are updated with the IRS. Make certain that the accounting process adheres to the law. Apply required construction bookkeeping standards and procedures to the recording and reporting of construction activity.Communicate with various financing companies (i.e. Title Company, Escrow Business) concerning the pay application procedure and requirements required for payment. Help with applying and keeping internal financial controls and treatments.

The above declarations are intended to describe the general nature and degree of job being done by people appointed to this classification. They are not to be taken as an extensive checklist of responsibilities, obligations, and abilities called for. Workers might be called for to carry out responsibilities beyond their regular responsibilities once in a while, as required.

Pvm Accounting Fundamentals Explained

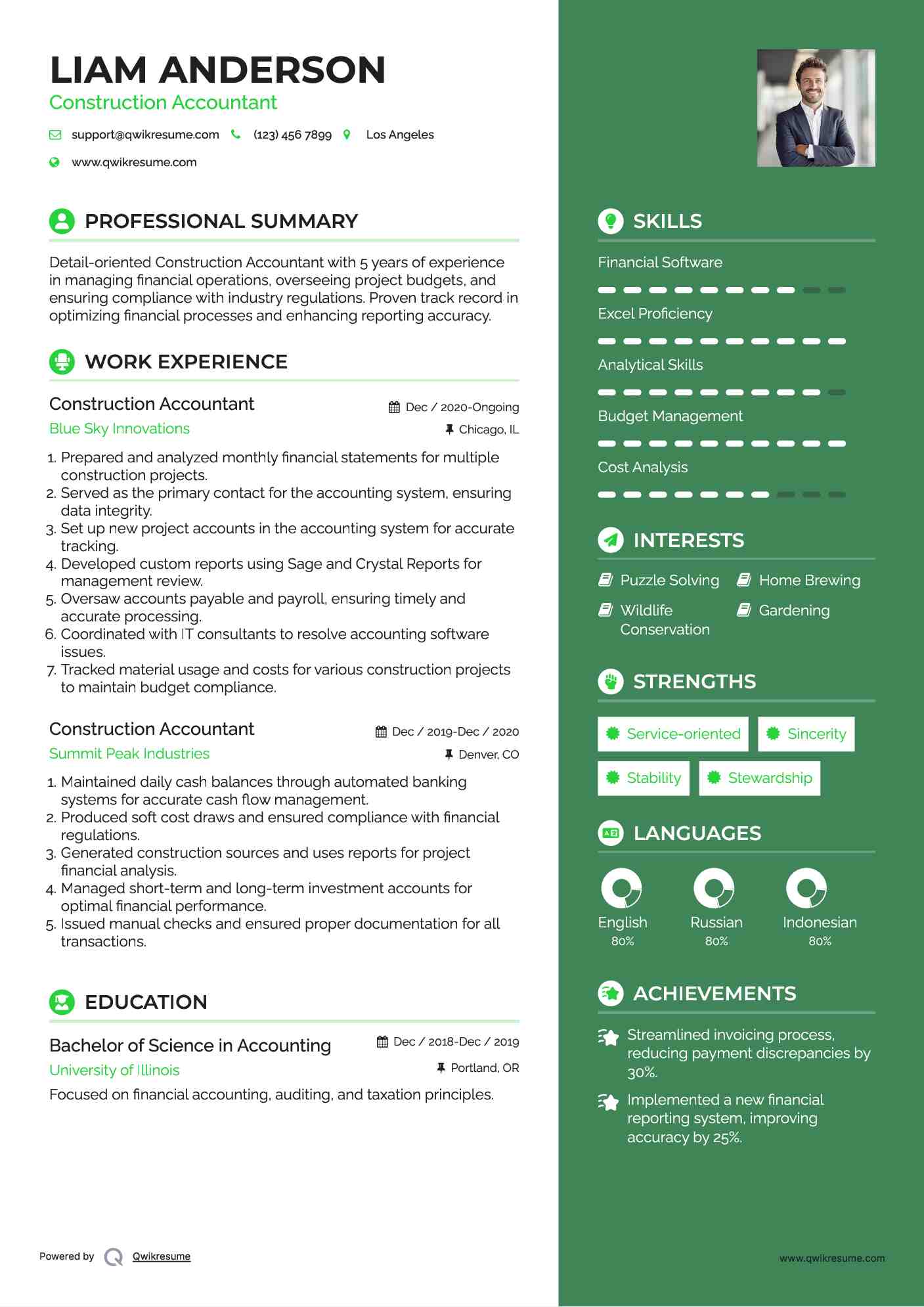

Accel is seeking a Construction Accountant for the Chicago Workplace. The Building and construction Accounting professional carries out a range of audit, insurance coverage conformity, and task administration.

Principal responsibilities consist of, however are not restricted to, taking care of all accounting features of the company in a timely and accurate manner and providing reports and routines to the business's certified public accountant Company in the preparation of all economic declarations. Ensures that all accounting treatments and features are handled precisely. Accountable for all monetary records, pay-roll, banking and daily procedure of the audit feature.

Prepares bi-weekly test balance records. Functions with Job Supervisors to prepare and upload all monthly invoices. Procedures and concerns all accounts payable and subcontractor repayments. Creates monthly wrap-ups for Employees Settlement and General Liability insurance policy costs. Generates regular monthly Task Cost to Date records and dealing with PMs to resolve with Project Supervisors' budget plans for each task.

The Single Strategy To Use For Pvm Accounting

Effectiveness in Sage 300 Construction and Property (previously Sage Timberline Office) and Procore construction management software application a plus. https://j182rvzpbx6.typeform.com/to/qpx4zyP8. Should likewise be competent in various other computer software application systems for the prep work of records, spread sheets and various other bookkeeping analysis that might be required by administration. Clean-up accounting. Should possess strong business abilities and capacity to focus on

They are the financial custodians who guarantee that building jobs continue to be on spending plan, comply with tax policies, and preserve monetary openness. Building and construction accounting professionals are not simply number crunchers; they are critical partners in the building process. Their primary role is to manage the financial aspects of construction projects, ensuring that resources are designated successfully and financial risks are minimized.

An Unbiased View of Pvm Accounting

By keeping a tight grasp on job funds, find out here now accountants aid avoid overspending and economic problems. Budgeting is a foundation of effective building tasks, and construction accountants are crucial in this respect.

Navigating the facility internet of tax guidelines in the building and construction industry can be difficult. Building and construction accountants are well-versed in these laws and make certain that the job adheres to all tax requirements. This includes handling pay-roll tax obligations, sales taxes, and any kind of other tax obligation responsibilities specific to building and construction. To succeed in the duty of a construction accounting professional, people require a solid educational foundation in audit and financing.

Furthermore, certifications such as Certified Public Accountant (CPA) or Licensed Building Sector Financial Expert (CCIFP) are highly pertained to in the market. Construction jobs frequently entail tight deadlines, altering laws, and unforeseen expenses.

Not known Facts About Pvm Accounting

Ans: Building and construction accountants create and keep an eye on budgets, recognizing cost-saving opportunities and making sure that the project remains within budget. Ans: Yes, building and construction accountants handle tax obligation compliance for building tasks.

Introduction to Building Accounting By Brittney Abell and Daniel Gray Last Updated Mar 22, 2024 Building companies need to make difficult options amongst several financial alternatives, like bidding on one task over another, selecting funding for products or tools, or setting a project's revenue margin. In addition to that, building and construction is a notoriously unpredictable sector with a high failure rate, sluggish time to settlement, and inconsistent cash flow.

Production includes duplicated procedures with easily identifiable costs. Manufacturing calls for different processes, materials, and devices with differing expenses. Each task takes location in a new location with varying website problems and unique difficulties.

Not known Facts About Pvm Accounting

Lasting connections with vendors relieve settlements and enhance effectiveness. Inconsistent. Regular use of different specialty professionals and providers affects efficiency and cash money flow. No retainage. Payment arrives in complete or with normal settlements for the complete agreement quantity. Retainage. Some part of payment might be held back up until job conclusion even when the contractor's job is ended up.

Routine manufacturing and temporary contracts bring about workable cash circulation cycles. Irregular. Retainage, slow-moving repayments, and high ahead of time prices cause long, irregular money flow cycles - Clean-up accounting. While typical makers have the advantage of regulated environments and maximized manufacturing processes, building companies need to constantly adapt to each new task. Even somewhat repeatable tasks call for adjustments as a result of site problems and various other elements.

Report this page